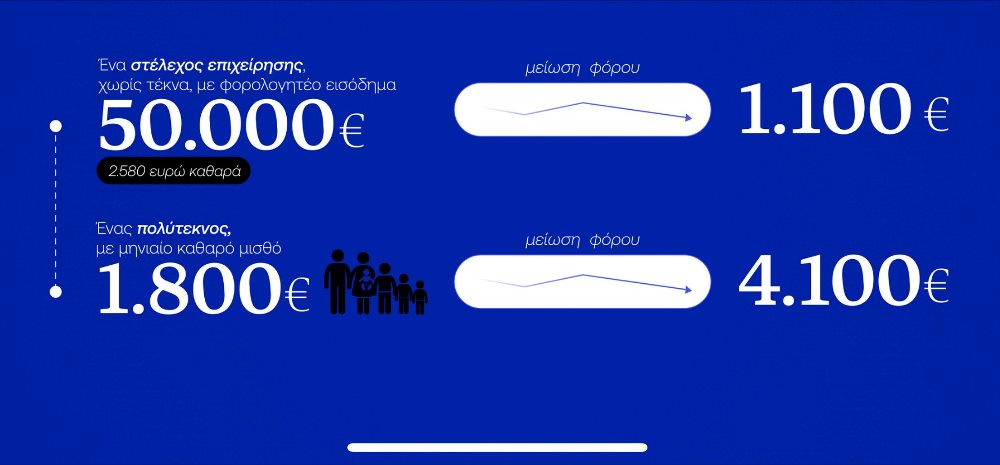

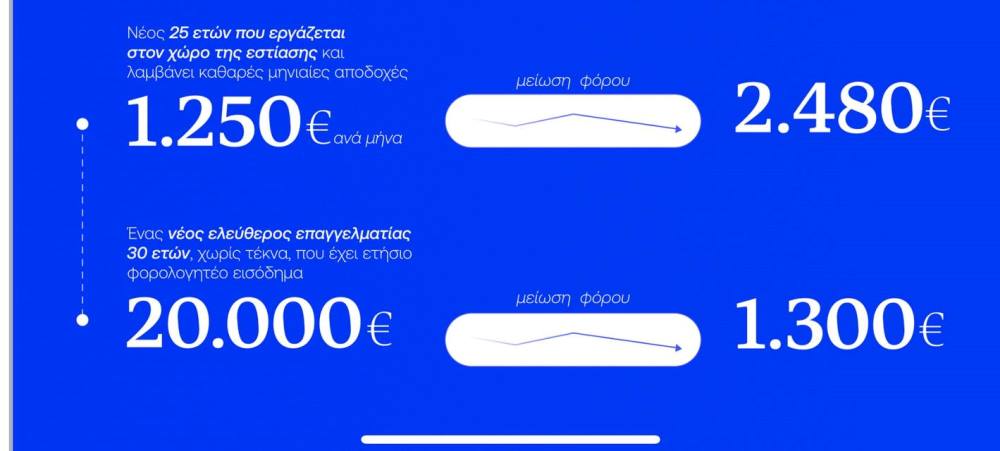

The prime minister presented at the Thessaloniki International Fair the measures of the new tax reform, which were detailed by the government today. The changes bring substantial tax relief for workers and affect every age and family status, taking effect from January 2026.

According to the data, the net annual benefit for each taxpayer will depend on age, salary bracket and number of children. For families with two working parents, the benefit is calculated as double.

As noted in his post by the Minister of State, Akis Skertsos, the reforms implemented systematically since 2019 — aimed at reducing tax evasion, boosting investments and ensuring fiscal stability — are now beginning to bear fruit. The beneficiaries are mainly the middle class, young people, families, employees, freelancers, rural residents and pensioners.

The government emphasizes that the Greek economy is now entering a “virtuous cycle”, which allows supporting popular incomes without deficits and debt, while ensuring the future of the next generations.

Akis Skertsos’ post

“What do workers of all ages and family situations gain from January 2026 thanks to the new tax reform?

Here you will find the detailed net annual benefit for each taxpayer according to their age, the salary bracket they are in and the children they have. For families with 2 working parents, calculate X2.

The reforms to reduce tax evasion, encourage private investment and fiscal responsibility that have been consistently implemented since 2019 are now returning their fruits to the middle class, the new generation, the Greek family, employees, freelancers, rural residents and, of course, pensioners.

The Greek economy, now moving in a virtuous cycle, supports popular incomes without creating deficits and debts, without mortgaging the future of the next generations.”