The new era of electronic payments officially begins on December 1, 2025, when all retail stores will be required to accept direct payments through IRIS. This innovative decision radically transforms the way transactions are conducted in Greek retail.

Read: IRIS: Technical changes from December 1, new data on retail transactions

IRIS payments: What the new obligation means for stores

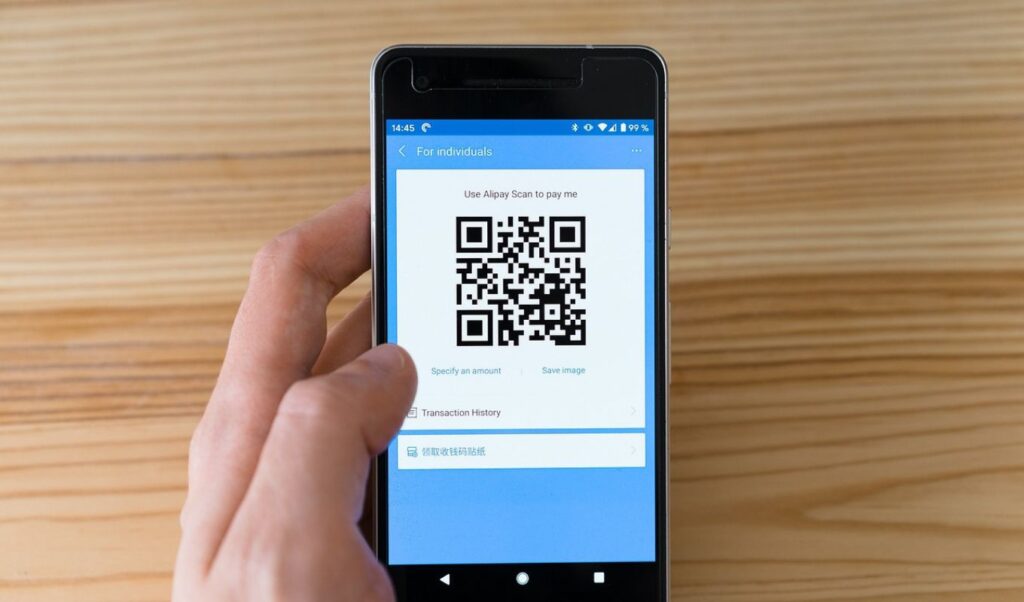

The groundbreaking decision by IAPR Governor Georgios Pitsilis inaugurates a new era in commercial transactions. Cash register systems are now directly connected to the Tax Administration, integrating instant money transfers into the daily shopping experience. Consumers will now enjoy three different payment options: cash, card, and instant IRIS payment via smartphone. The technology enables instantaneous transfers directly from personal bank accounts to business accounts, while receipts are automatically generated and simultaneously sent to the IAPR.

Which businesses are included in the new regime

The new framework mandatorily includes:

- Supermarket chains and large shopping centers

- Retail stores across all sectors

- Every business serving private consumers

- All points of sale with B2C activity

How the electronic payment process is changing

Every electronic transaction, whether conducted by card or through IRIS, is automatically linked to receipt issuance. This innovation definitively eliminates the possibility of payment collection without corresponding receipts, enhancing transparency in commercial transactions.

Deadlines and obligations for preparation

Technology companies and payment system providers have until November 28, 2025, to declare compliance with the new technical specifications to DIAS and IAPR. Meanwhile, businesses must update their cash register systems and POS terminals for seamless transition.

Benefits for tax transparency

Through this initiative, the IAPR achieves complete recording of electronic transactions in real time. The result is significant enhancement of tax transparency and dramatic reduction of tax evasion phenomena in the retail sector.