The government’s economic team is examining the conditions under which it could promote new tax reductions on real estate income, with the Prime Minister making it clear that the reduction will only happen if declared rental income increases. “I have committed that if we see an increase in declared rental income, I am ready to reduce rental taxation next year. I believe this creates a positive compliance cycle, with money ultimately returning to society,” emphasized K. Mitsotakis in his radio interview on SKAI 100.3. According to sources, the economic team believes that tax compliance will result in rental price containment.

Tax cuts with rental transparency: Huge gap between reality and ministry data

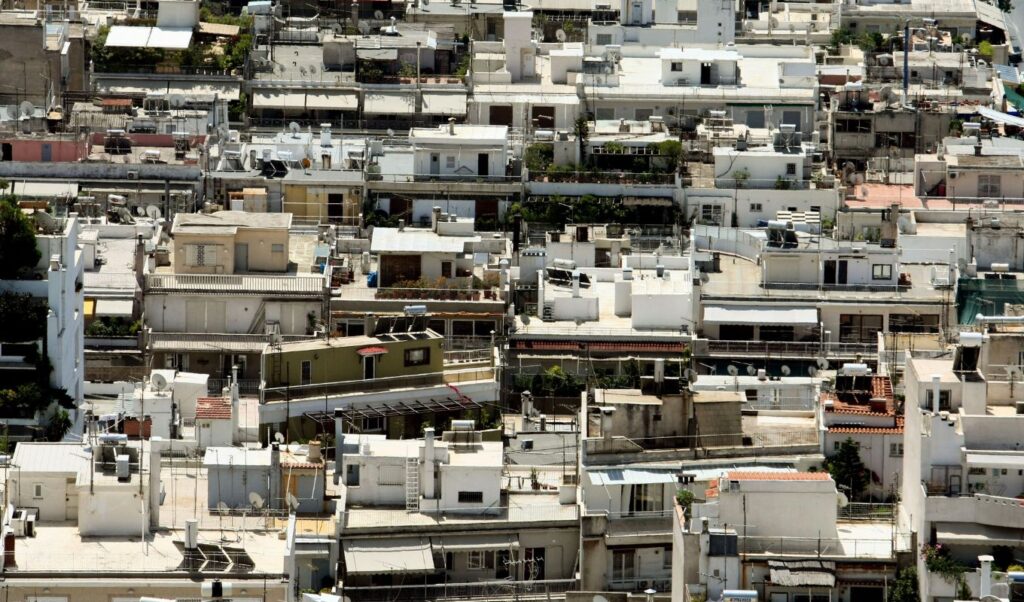

Furthermore, the gap between the real situation in the housing rental market and the data available to officials at the Ministry of National Economy and Finance from housing leases is enormous and does not reflect the reality faced by citizens seeking affordable housing. Characteristically, according to Tax Authority data, in 2023 the average declared income for primary and student housing was only 255 euros, with actual prices being up to 4 times higher than amounts appearing in tax returns. Factors that appear to reinforce the divergence between real prices and “paper” amounts include rental income underreporting, non-declaration of rental income, while cash payments and lack of formal contracts contribute to perpetuating this phenomenon. It’s worth noting that from January 1, 2026, all property rent payments must be made through bank accounts, according to article 210 of law 5222/2025.

The Digital Property Ownership and Management Registry – How it will function

In this context, the Tax Authority’s cross-reference procedures for rental refunds being completed gradually, to ensure beneficiaries meet all necessary criteria for November rental refunds, during which landlord and tenant data are verified, lease declarations and deposited amounts are checked, will provide a clearer picture of the market, as beneficiaries will receive refunds based on actual rental amounts they pay.

A complete picture of properties will be provided by the Property Ownership and Management Registry (MIDA), established by the Tax Authority, which will be updated through taxpayer declarations and can connect through interoperability with the Unified Property Registry (EMA) of the Hellenic Cadastre and other digital systems maintained by public and private sector entities containing property-related information.

This is a comprehensive digital registry where information and data regarding property ownership and management will be collected and maintained. Practically, an individual file will be created for each property in the country, with all necessary information, such as surface area, location, floor, whether it’s electrified, incomplete, vacant, or rented. MIDA will facilitate electronic cross-references and identification of potentially undeclared rental income through electricity consumption monitoring. Consequently, it’s expected to contribute to transparency and tax evasion reduction. It essentially constitutes a comprehensive digital registry where information and data regarding property ownership and management will be collected and maintained. Practically, an individual file will be created for each property in the country, with all necessary information, such as surface area, location, floor, whether it’s electrified, incomplete, vacant, or rented.

The Registry includes all information and data for property ownership and management, consolidating data maintained in Tax Authority information systems concerning property type and description, property rights, property use, and any other property-related information. MIDA is updated: a) through declarations submitted to the Tax Authority including property-related elements from the first paragraph, and b) through information provided by third parties to the Tax Authority.

In the same framework, according to Thessaloniki International Fair announcements, from tax year 2026 an intermediate 25% tax rate is established for rental income between 12,000 and 24,000 euros. Currently, up to 12,000 euros a 15% rate applies, then increases to 35%. An estimated 161,587 property owners will benefit directly, however this measure is expected to work positively for tax compliance and rental price containment. The fiscal cost is estimated at 90 million euros annually, affecting 2027 and subsequent years.

Published in Sunday Afternoon Edition