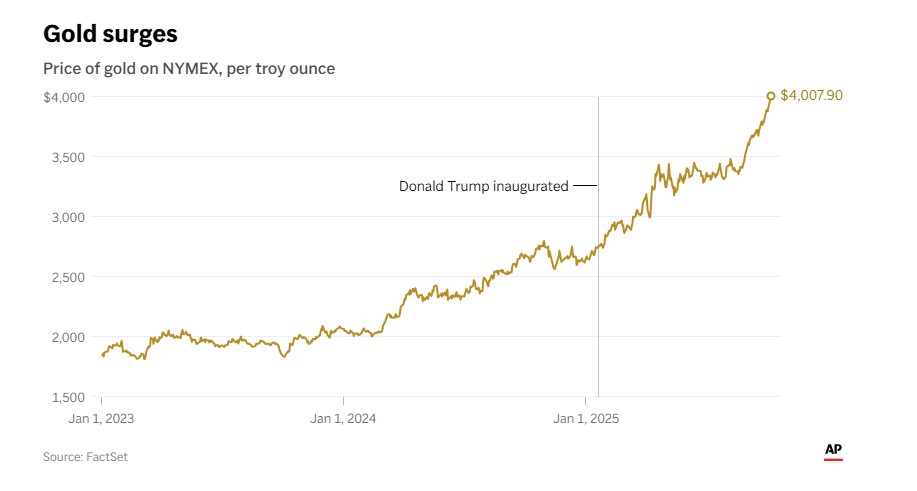

Gold prices have reached unprecedented levels, with the precious metal in the spot market trading above $4,000 per ounce for the first time ever. Investors appear to be seeking “safe havens,” turning away from the dollar, particularly in the wake of Donald Trump’s “turbulent” governance and changing trade conditions due to tariff implementation. This trend has intensified due to the U.S. federal government shutdown, while gold’s rise is also fueled by geopolitical uncertainty and the crisis affecting the Eurozone’s second-largest economy, France.

Overall, gold futures contracts have reached record levels compared to a year ago, appreciating by 50% since the beginning of the year, according to an Associated Press analysis. On Tuesday, they reached $4,003 per ounce, compared to $2,670 per ounce in January.

Read: Gold prices soar: Surpasses $4000 per ounce for the first time

Gold prices remain open to further gains: Could reach $5000 per ounce

“There’s so much confidence in this trade right now that the market will look for the next big number, which is $5,000, with the Fed likely continuing to cut interest rates,” independent metals trader Tai Wong told Reuters. “There will be some disruptions, like a lasting ceasefire in the Middle East or Ukraine, but the fundamental factors affecting the trade – massive and growing debt, reserve diversification, and dollar weakening – are unlikely to change in the medium term.”

Fed announcements are crucial

Federal Reserve interest rate announcements play their own critical role, with CNN noting that markets continue to expect a 0.25% rate cut at the Fed’s October 28-29 meeting and a similar-sized reduction at the December meeting.

“I believe gold will reach $4,300 per ounce in the next six months as the U.S. dollar is expected to continue depreciating,” said Michael Langford, chief investment officer at Scorpion Minerals, to the American media outlet.

Billionaire investor Ken Griffin said Monday that gold’s evolution as a safer asset than the dollar is “truly concerning.”

“We’re seeing significant inflationary trends in assets moving away from the dollar as people seek ways to effectively de-dollarize or reduce their portfolio risk against U.S. sovereign risk,” he said in a Bloomberg interview.

What fueled the gold rally

For gold to reach its highest levels since the 1970s and “gallop” since April, the tariffs announced by the American president played a decisive role, while the shutdown and intensification of uncertainty around U.S. economic data has created its own dynamic. The federal government suspension has delayed the publication of key economic indicators from the world’s largest economy, forcing investors to rely on secondary, non-governmental data to assess the timing and extent of Fed interest rate cuts.

Additionally, political turmoil in France and Japan has also boosted demand for gold as a safe haven.

“The latest rise was triggered by Sanae Takaichi’s election over the weekend and the prospect of larger spending deficits in Japan. This connects to a key theme of the moment: the ‘run it hot’ trade,” Capital.com analyst Kyle Rodda told Reuters.

The reversal of an unusual trend

Until now, something unusual was happening: the parallel rise of both gold and stocks in major financial markets, with the S&P 500 recording a 13% gain since the beginning of the year.

This now appears to be reversing as overnight in the U.S., the three main indices closed lower. As CNBC reports, the S&P 500 recorded “losses” after 7 consecutive sessions of gains.