The electronic application went live on Wednesday morning (1/10), allowing taxpayers to calculate the financial benefits from the tax reform for Demographics and the Middle Class. This is a web application, accessible from any browser on computer (PC/Mac), tablet or mobile phone, at www.taxcalc2025.minfin.gr. It does not use citizens’ tax data, nor does it store information, and it doesn’t use cookies. It was developed entirely by the staff of the Ministry of National Economy and Finance and is hosted on the G-Cloud of the Ministry of Digital Governance.

In just a few seconds, every citizen can verify with relative accuracy the tax reductions that will apply from 2026. For employees, these reductions are equivalent to salary increases from January of the new year, while for freelancers the benefit will be reflected in 2027.

How to calculate your benefit from the new tax measures

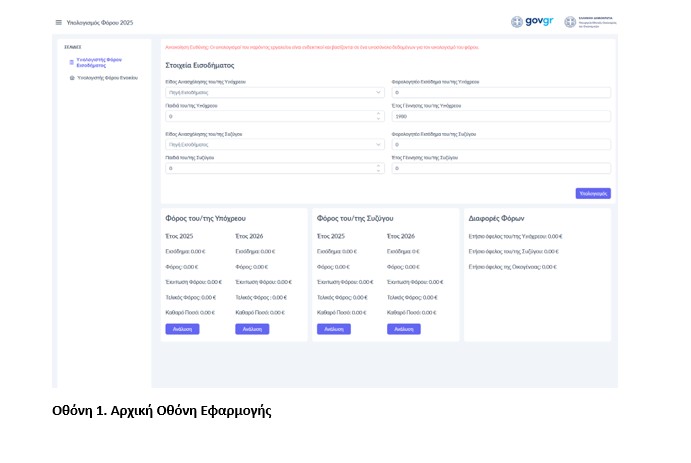

The initial screen is shown in the image below.

Every citizen can choose the Income Tax Calculator displayed on the initial screen or the Rental Tax Calculator.

1. Income Tax Calculator

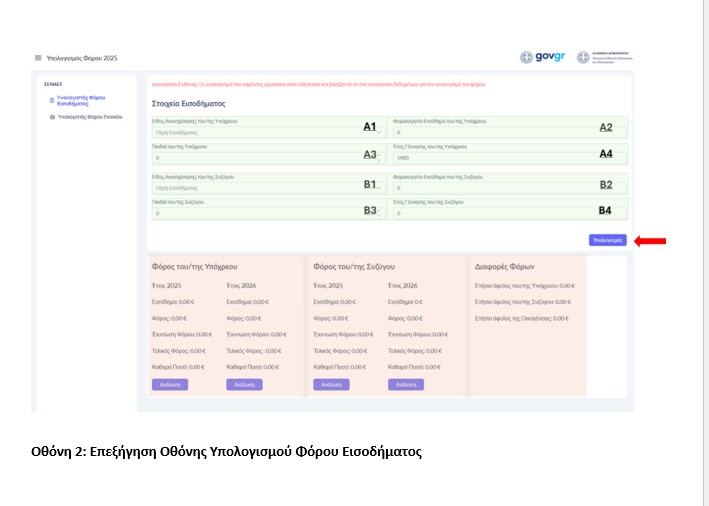

On the Income Tax Calculator screen, the taxpayer needs to enter the following information (see Screen 2 – items in green background):

A. For the Taxpayer: A1- Type of Employment, A2 – Taxable income and A3 – Children of the Taxpayer and A4 – Year of birth

B. For the spouse’s income: B1- Type of Employment, B2 – Taxable income, B3 – Spouse’s Children (which in most cases are the same as the Taxpayer’s children) and B4 – Year of birth.

If there is no spouse, leave the fields blank.

Then the taxpayer must click the Calculate button and the application will automatically calculate the reductions. (Screen 2 – items in pink background).

The results show for the Taxpayer and Spouse and for the years 2025 and 2026:

• The taxable income

• The scale tax before the tax deduction available if they are Employee / Pensioner or professional Farmer

• The tax deduction available if they are Employee / Pensioner or professional Farmer

• The final scale tax after the deduction.

• The net amount resulting

In a separate column, the annual individual benefit of the Taxpayer, Spouse and family benefit are displayed.

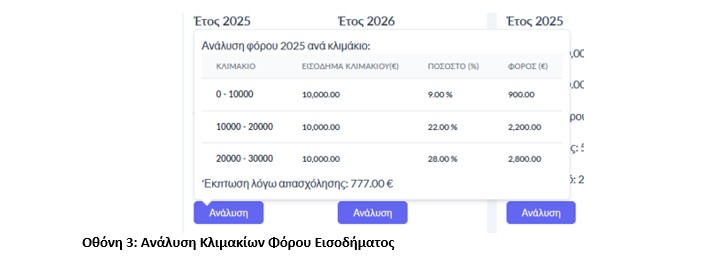

By selecting “Analysis”, the calculation justification for the tax (Screen 3: Analysis of Income Tax Brackets) for the tax brackets and the tax deduction that employees, pensioners and farmers have, depending on the number of children in each family, is displayed.

2. Rental Tax Calculator

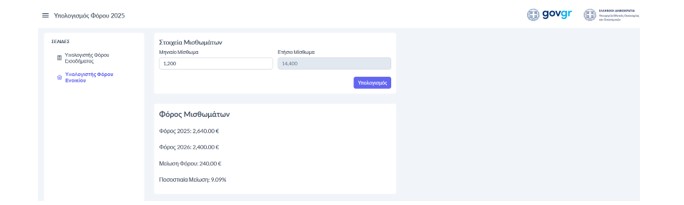

By selecting “Rental Tax Calculator” from the left menu, the relevant screen appears (Screen 4. Rental Tax Calculator).

Taxpayers must enter the monthly rent and click the “Calculate” button. The application calculates the annual rent, the tax for 2025, the tax for 2026, the resulting difference as well as the percentage reduction in tax.

It is reminded that, after the passage of the relevant bill with the measures from the Thessaloniki International Fair, which is expected within October, the AADE will proceed to create a second benefit calculation platform. The new platform will automatically draw citizens’ data from its database, offering even greater accuracy in results.

Tax relief measures that received “green light” from the Cabinet

The measures approved by the cabinet meeting held yesterday (30/9) are:

A. Tax Regulations

- Reform of income tax scale for employees, pensioners, farmers and freelancers with emphasis on the middle class, families with children and young people.

General interventions:

- Tax rates are reduced by 2% for the scale from €10,000 to €40,000:

- For €10,000 to €20,000 from 22% to 20%

- For €20,000 to €30,000 from 28% to 26%

- For €30,000 to €40,000 from 36% to 34%

- An intermediate rate is introduced from €40,000 to €60,000 at 39%, while the 44% rate will apply to income above €60,000.

Additional interventions for families with children:

- The rate from €10,000 to €20,000 which will now amount to 20% for taxpayers without children, is further reduced according to the number of children and even more for families with three children to:

- 18% for taxpayers with 1 dependent child

- 16% for taxpayers with 2 dependent children

- 9% for taxpayers with three dependent children

- Rates from €0 to €20,000 are zeroed for taxpayers with four or more dependent children.

- The rate from €20,000 to €30,000 which will now amount to 26% for taxpayers without children, is also reduced by 2 percentage points for each child:

- 24% for taxpayers with 1 dependent child

- 22% for taxpayers with 2 dependent children

- 20% for taxpayers with three dependent children

- 18% for taxpayers with four dependent children

- 16% for taxpayers with five dependent children etc.

Additional interventions for young people:

- For young people up to 25 years old, rates from €0 to €20,000 are zeroed.

- For young people aged 26 to 30, the rate from €10,000 to €20,000 will amount to 9%.

The above interventions will be implemented from tax year 2026 and (a) employees and pensioners will see the benefit from January 2026 payroll with the increase in their monthly net wages as tax is withheld, (b) individual enterprises and farmers will see the benefit when submitting tax returns for tax year 2026 in March 2027. Approximately 4 million taxpayers who today are subject to income tax based on their income benefit.

- Gradual abolition of ENFIA property tax for main residences in settlements with up to 1,500 inhabitants

From 2026 the tax is reduced by 50% and from 2027 property rights on real estate concerning main residence and belonging to natural persons, Greek tax residents, whose main residence as shown in the income tax return is located in settlements with population less than one thousand five hundred (1,500) inhabitants, excluding settlements in Attica Region (except the Islands Regional Unit), are exempted from ENFIA. Specifically for Evros Regional Unit the limit is set at one thousand seven hundred (1,700) inhabitants. Residences with total taxable value above €400,000 are excluded. The measure is estimated to affect approximately 1 million property rights on residences in these areas. It concerns 12,720 settlements (out of 13,586 settlements total) in the country both on mainland and island Greece.

- Reduction in real estate income taxation

From tax year 2026 an intermediate rate of 25% is established for rental income from €12,000 to €24,000. It is recalled that today up to €12,000 a rate of 15% applies and then increases to 35%. Direct beneficiaries are estimated at 161,587 property owners.

- 30% VAT reduction in border Aegean islands with up to 20,000 inhabitants

From 1/1/2026 VAT is reduced by 30% on islands of the North Aegean Region, Evros Prefecture (Samothrace) and Dodecanese prefecture with population up to 20,000 inhabitants.

- Reduction of living standard presumptions

Presumptions for residences are reduced by 30% to 35%. For cars, for those registered after 2010, presumptions will be calculated based on emissions, with significant benefit for cars under a decade old. Additionally, dependent children with the same income will be excluded from the minimum objective expenditure of €3,000. Beneficiaries are approximately 477,000 taxpayers with additional tax difference due to living standard presumptions.

- Extensions of tax incentives to address the housing problem

- The income tax exemption for 3 years for empty residences that will be rented in long-term lease is extended for 2026.

- The suspension of VAT on new constructions is extended for one more year, until the end of 2026.

- Establishment of 100% super-deduction regime for investment expenses in strategic defense and vehicle manufacturing sectors

To incentivize private investments in strategic sectors where activity in the Greek market is currently extremely limited, investment expenses relating to defense and vehicle, aircraft and component manufacturing sectors will be deducted from gross business income at the time of their realization, increased by one hundred percent (100%). Additionally, these investments will be given the fast-track licensing incentive, as with strategic investments.

- Abolition of subscription television fee

From January 2026 the subscription television fee that burdens more than 1 million subscription television accounts, both households and businesses, is abolished. The fee currently amounts to 10% of the total monthly bill.

- Interventions in minimum income for freelancers

- The provision for 50% reduction of minimum income that currently applies to settlements with population up to 500 people or municipal communities outside Attica with population up to 1,500 people, is extended to all settlements outside Attica with population up to 1,500 people. Consequently, 176 settlements that were marginally excluded from the regulation are included in the reduced amount. Additionally, school canteens nationwide will have a 50% reduction.

- New mothers practicing freelance professions are excluded from presumptive income during the year of childbirth and the following two years. An estimated 6,000 new mothers benefit.

B. Major salary regulations

- Police, fire service and coast guard salary reform with increases from October 2025.

- Salary regulations for Ministry of Foreign Affairs staff: For Foreign Ministry staff, (a) increase of special duties allowance from €120 to €184 depending on position, (b) establishment of special duties allowance for additional Foreign Ministry sectors and (c) increase of compensation for children’s tuition fees is provided. It is noted that by joint ministerial decision the foreign service compensation will also increase, depending on the country where staff serve.

- Polytechnic diplomas and other universities with five-year study cycles are recognized salary-wise, proportionally to master’s degrees, with promotion by two salary scales. An estimated 5,000 public employees will benefit with annual cost of €7 million.

- Tax exemption is established for library allowance of faculty members and researchers.

New specific regulations introduced, in addition to those announced at the Thessaloniki International Fair:

- The validity of incentives for conducting transactions with electronic payment methods is extended for tax year 2026. Specifically, for 2026 a deduction from taxable income of natural persons of 30% of expenses made with electronic payment methods to specific professionals and up to €5,000 annually is provided. Additionally, expenses for medical, dental and veterinary services count double toward the minimum limit of 30% expenses with electronic payment methods.

- In the gradual abolition of ENFIA for settlements up to 1,500 inhabitants and considering special conditions in Evros Regional Unit and the issue that arose with Nea Vyssa, the gradual ENFIA abolition specifically for Evros Regional Unit will apply to settlements recorded in the census with up to 1,700 inhabitants.

- In income taxation, in addition to general tax reductions, the autonomous taxation rate for doctors’ emergency services is also reduced from 22% to 20%.

- In extending the 2026 exemption from property income tax for properties rented with long-term lease, the following modifications are made:

- Currently the exemption applies to residences up to 120 sq.m. If the rental concerns a family with three or more children, the exemption will be given for houses with larger area. Specifically the above limit of 120 sq.m. is expanded by 20 sq.m. for each dependent child above two.

- Currently the exemption concerns the first lease of at least 3 years duration. However it does not continue if within the three-year period the tenant leaves and a new long-term lease