All employees in the private and public sectors will see increases in their net monthly salaries from January 1, 2026. In the higher income brackets, benefits reach up to €370 per month, while increases are smaller in the lower brackets.

Read: Taxes: How much they decreased since 2019 – Detailed table – What the Ministry supports

The final amounts will depend on income level, age, and family status of each taxpayer. The reduction in tax rates, announced by the Prime Minister at the Thessaloniki International Fair, leads to lower tax withholding and increased disposable income.

Who benefits and how much from the tax cuts

According to estimates, approximately 4 million households will benefit from these changes. Leading the beneficiaries are 260,000 young people up to 30 years old, as well as families with children, who will see their monthly salaries increase significantly from the new year.

It should be emphasized that the reform strategy focuses on young people. For young people aged 26-30 with €15,000 taxable income, the annual benefit will be €650, meaning a €46.4 increase in their net monthly salary. For €20,000 taxable income (€1,250 net per month), the annual benefit amounts to €1,300, or €93 per month, so €1,250 becomes €1,343. Also, 30-year-olds without children with €25,000 taxable income (€1,500 net) will have an annual increase of €1,400, or €100 per month over 14 salaries, so their net salary increases from €1,500 to €1,600 from January 1, 2026.

It’s noted that after the tax bracket interventions, tax-free thresholds for employees, pensioners, and professional farmers are set at €8,643 for taxpayers without children, €10,000 for taxpayers with one child, €11,375 (from €11,000) for taxpayers with two children, €14,364 (from €12,000) for taxpayers with three children, and €27,100 (from €13,000) for taxpayers with four children.

Detailed examples

- A 25-year-old working in hospitality earning €1,250 net monthly will have an annual tax reduction of €2,480, equivalent to almost two salaries.

- A young person up to 25 years with €15,000 annual taxable income (€980 net monthly) will benefit €1,283 annually, with monthly net salary increasing by €91, so €980 becomes €1,071 net monthly.

- A young person with €20,000 taxable income (€1,251 net monthly) will have a tax reduction of €2,483 annually, equivalent to a €177 monthly increase, so their net salary rises from €1,250 to €1,427.

- A young person with €25,000 taxable income (€1,500 net monthly) will have a €229 increase, so €1,500 net becomes €1,729.

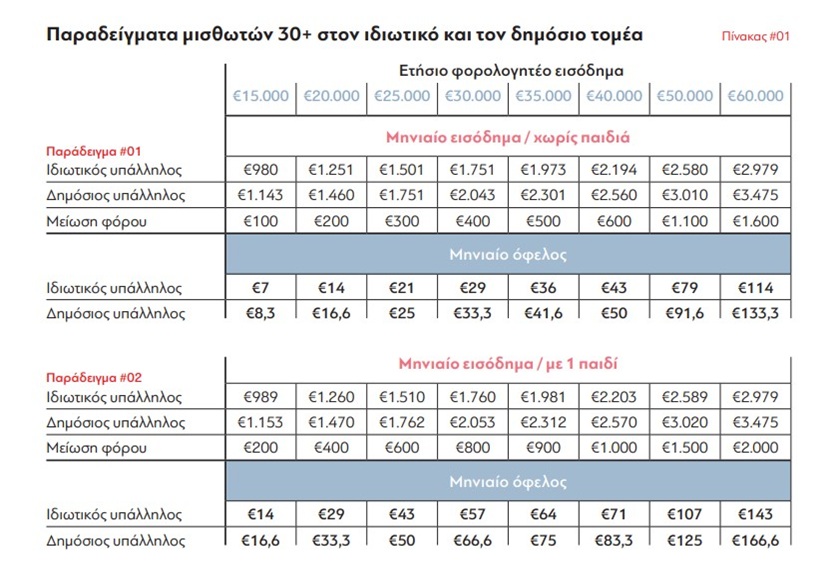

However, tax burden reductions don’t only affect young people. Older workers will also see their salaries increase from January 1, 2026.

An employee with €20,000 taxable income (€1,251 net monthly salary) without children will have an annual benefit of €200, with one child €400, with two €600, with three €1,300, and with four children €1,680. For €25,000 taxable income (€1,500 net), the tax reduction without children is €300 annually, with one child €600, and with two children €900.

Thus, a worker earning €1,500 net with 14 salaries will see an additional €64 net in their January 1, 2026 salary, making €1,500 become €1,564. Someone with 12 salaries will have a €75 increase, with net salary rising to €1,575. With three children, they’ll have an annual tax reduction of €1,700, meaning €121 monthly, so €1,500 salary becomes €1,621 on January 1.

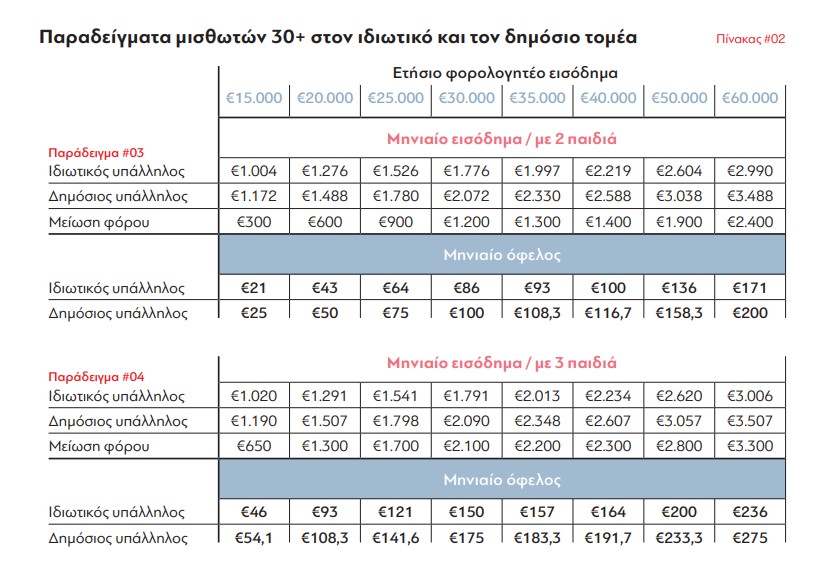

With four children, the annual benefit reaches €3,180, or €227 monthly, so €1,500 becomes €1,727 monthly from January 1 due to income tax reduction. For €30,000 taxable income (approximately €1,700 net salary), the tax reduction without children is €400, with one child €800. An employee with two children will have an annual benefit of €1,200, and if receiving 12 salaries, €100 monthly net, while if receiving 14 salaries, €86. Therefore €1,750 becomes €1,836 with 14 salaries and two children, €1,900 with three children (€150 monthly), and €2,042 with four children (€292 monthly). Employees and pensioners with €40,000 annual income without children gain €600 annually, with one child €1,000 annually, with two children €1,400, with three €2,300, while those with many children gain €4,300 annually.

For a private sector worker with four children and €30,000 income, the tax reduction and salary increase is €4,100 annually or €292 monthly, while for €40,000 income it rises to €4,300 annually or €307 monthly, and for €50,000 income the benefit reaches €4,850 or €346 monthly. A parent with many children earning €1,800 net monthly will have a tax reduction of €4,100, equivalent to almost 2.3 salaries.

A parent with many children and taxable income over €60,000 will have a tax reduction of €5,300 annually, meaning their monthly net salary will increase by €378 from January 1, 2026.

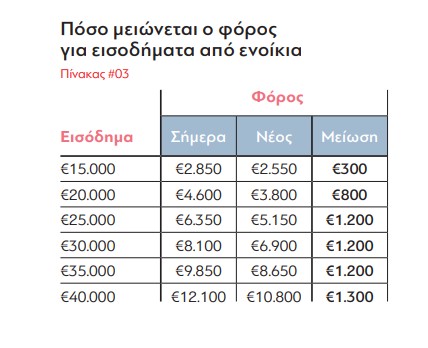

Property owners

Significant tax relief will benefit 161,587 taxpayers with property income exceeding €12,000 in 2026. The benefit will be seen in 2027 when tax returns are filed. The change comes from introducing a new intermediate tax rate of 25% for income between €12,000-€24,000. Currently, up to €12,000 applies a 15% rate and amounts over €24,000 face a 35% rate. The relief can reach up to €1,300.

Presumptive taxation

Reduced living standards presumptions will apply from 2026, following government interventions. Specifically:

a. Residences

30%-35% reduction, depending on area and objective zone value. The goal is reducing minimum annual incomes required for property maintenance.

b. Cars

7.2%-50% reduction for cars up to 10 years old, aligning presumptions with actual maintenance costs. For cars up to 15 years old, presumptions will be calculated based on CO₂ emissions instead of cubic capacity.

c. Recreational boats

30% reduction for newer boats, while sailing boats and traditional Greek wooden vessels see 50% reduction. The goal is strengthening owners’ purchasing power. Additionally, dependent children with their own income will be exempt from the €3,000 minimum presumption. The annual fiscal cost of changes is estimated at €40 million, benefiting approximately 477,000 taxpayers. Changes will apply to 2025 income, with benefits appearing in 2026 tax returns.

Published in Parapolitika