The extrajudicial mechanism is showing strong momentum, with August 2025 data revealing a significant increase in settlements and new applications. According to the Ministry of National Economy and Finance, 1,231 settlements totaling €317 million were completed, representing an 18.5% increase compared to the same month last year. This positive trajectory is attributed to the expansion of eligibility criteria and improvements that make settlement proposals more effective for households and businesses.

High rates in the extrajudicial mechanism

Specifically, the Press Office of the Ministry of National Economy and Finance issued the following announcement:

The extrajudicial mechanism moved at high rates this past August, despite this month not being counted toward deadlines for completing the procedure, as stipulated in Article 16 of Law 4738/2020, paragraph 1. More specifically, last month 1,231 settlements worth €317 million were completed, showing an 18.5% increase compared to the 1,039 settlements in August 2024 and a spectacular 78% increase compared to the 691 settlements in August 2023.

Similarly, new application initiations recorded a 10% increase compared to the corresponding month last year and a 45% increase from the year before. Submissions also recorded significantly higher numbers, showing a 26% increase compared to last year’s corresponding month and a 70% increase compared to two years ago. Specifically, in August 2025, there were 3,340 new applications and 2,896 submissions compared to 3,031 applications and 2,338 submissions in the same month of 2024 and 2,305 applications and 1,715 submissions in 2023.

In total, 41,748 successful settlements are recorded for initial debts amounting to €13.56 billion that have been settled through the extrajudicial mechanism through the end of August.

The significant increase in all indicators reflects the substantial coverage of the middle class through the expansion of eligibility criteria and all improvements collectively, which daily provide realistic settlement proposals to households and businesses.

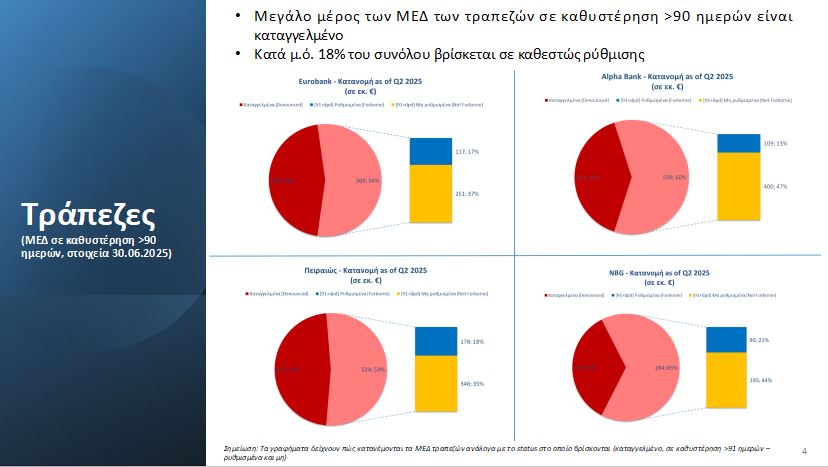

Banking data

According to the monthly progress report from the General Secretariat of Financial Sector and Private Debt Management, during the first half of 2025, 17.5% of non-performing loans in bank portfolios are under settlement arrangements, while the percentage of defaulted loans reaches an average of 42%.

The non-performing loan ratio decreased by 0.2 percentage points at the close of Q2 2025 compared to the previous quarter. According to the latest data from the Bank of Greece (Q2 2025), the index stood at 3.57%, down from 3.77% (Q1 2025), marking a new historic low since 2002.

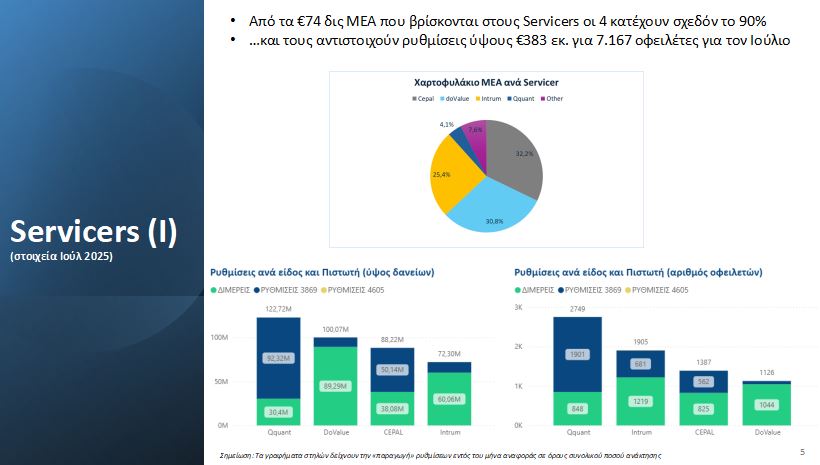

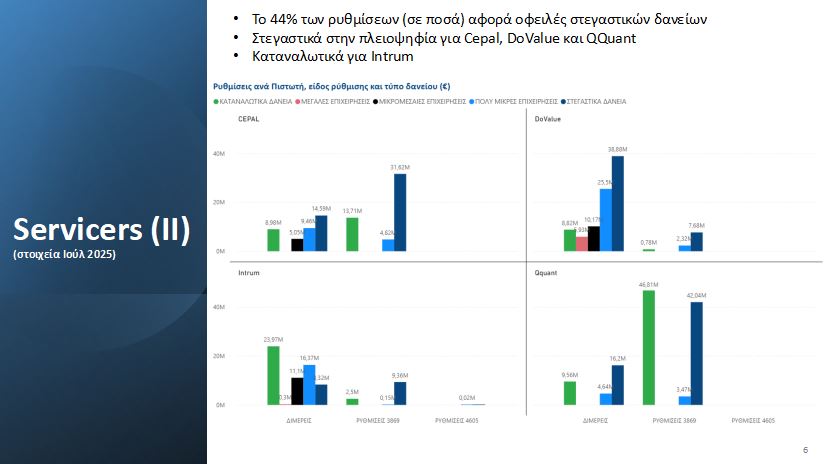

Bilateral arrangements with servicers

The positive trend continues in bilateral loan arrangements with the 4 largest Credit Servicers (Intrum, Cepal, DoValue, Qquant). In July, successful settlements worth €383 million were completed, corresponding to 7,167 debtors.

It is reminded that, aiming for more effective utilization of available debt settlement tools, the General Secretariat of Financial Sector and Private Debt Management provides nationwide service through video calls or phone calls, by appointment, through the platform (https://www.gov.gr/ipiresies/polites-kai-kathemerinoteta/ex-apostaseos-exuperetese-politon/exuperetese-me-telediaskepse-kai-telephonike-epikoinonia-apo-ten-eidike-grammateia-diakheirises-idiotikou-khreous-egdikh) or by phone at 213.212.5730.