Greek Prime Minister Kyriakos Mitsotakis announced what he called the “biggest tax reform” of Greece’s post-dictatorship era on Saturday evening (6/9) at the Thessaloniki International Fair. The permanent tax cuts worth €1.6 billion will reduce the tax burden for approximately 4 million taxpayers. Pensioners are also at the center of the reforms, as the personal difference will be reduced by half in 2026 and completely abolished in 2027, providing additional benefits to 671,000 retirees.

The comprehensive tax relief package announced by Kyriakos Mitsotakis aims to support families with children and the middle class, while addressing demographic challenges and the depopulation of remote areas. The prime minister emphasized that the government strategy remains steadily focused on permanent tax cuts and substantial interventions, rather than horizontal subsidies, in order to boost growth and relieve households from high costs.

Mitsotakis at TIF: Tax rate reductions and incentives for families

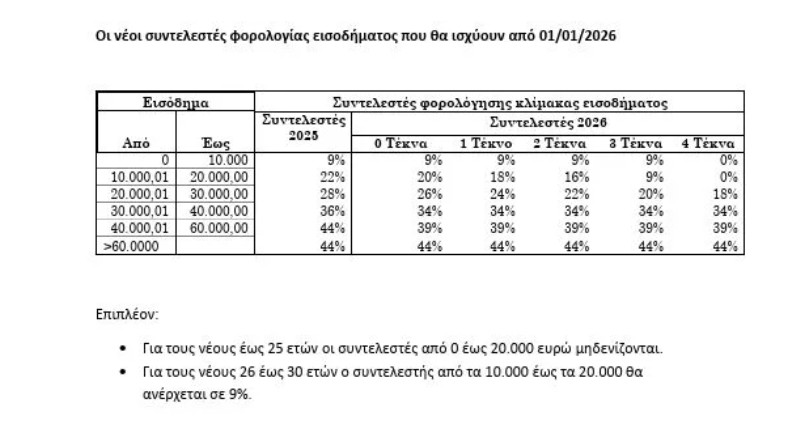

All tax rates are reduced by 2 percentage points (except the introductory 9%). In the €10,000–20,000 bracket, the rate drops from 22% to 20% and is further reduced per child: 18% with one, 16% with two, 9% for three children, 0% for large families.

For an annual income of €20,000, the benefit amounts to €600 with two children, €1,300 with three and €1,680 with four. The change applies to individual, not family income. An intermediate rate of 39% is also established for incomes of €40,000–60,000. Implementation in withholding tax starts on 01.2026.

Ανακοινώνουμε σήμερα ένα σχέδιο που ανακουφίζει ταυτόχρονα πάνω από 4 εκατομμύρια φορολογούμενους. Κάτι που σημαίνει αυτόματα και μόνιμη αύξηση εισοδήματος σε μισθωτούς και επαγγελματίες, σε αγρότες και συνταξιούχους. Ιδίως, όμως, στις οικογένειες και τους νέους. pic.twitter.com/aST61GZ6Sh

— Prime Minister GR (@PrimeministerGR) September 6, 2025

Young people up to 30 years old

Perhaps the most significant change attempted within this broad tax reform concerns young workers. “Our most important intervention concerns young people,” the prime minister emphasized, announcing zero tax for workers up to 25 years old with income up to €20,000 and a reduction to 9% from 22% until they turn 30.

Based on the examples given, the initiative for young people is structured as follows:

- Up to 25 years old, with €15,000: annual benefit of €1,283

- Up to 25 years old, with €20,000: annual benefit of €2,480

- From 26-30 years old, with €20,000: annual benefit of €1,300

Στηρίζουμε έμπρακτα τους νέους μας. Κανένας εργαζόμενος έως 25 ετών με έσοδα μέχρι και €20.000 δεν θα πληρώνει φόρο. pic.twitter.com/xUEH4iXOQb

— Prime Minister GR (@PrimeministerGR) September 6, 2025

Pensions – personal difference

The personal difference is reduced by 50% in 2026 and completely abolished in 2027, creating additional benefits for 671,000 pensioners, beyond tax cuts and annual pension adjustments.

What changes in rental income after Mitsotakis’ TIF announcements

A 25% tax rate is established for the €12,000–24,000 segment (remains 15% up to €12,000), to break the jump to 35%. With the permanent “return of one rent” every November, incentives for declaring real rental amounts are strengthened. With improved compliance, further reductions in property taxation will be examined.

ENFIA and VAT in the regions

ENFIA for primary residence in villages under 1,500 inhabitants is reduced by half in 2026 and abolished in 2027, as an incentive for population retention and return. Additionally, VAT is reduced by 30% on remote islands under 20,000 inhabitants, beyond the five where it already applies, with extension to zones in the North Aegean, Dodecanese and Evros.

Living standards assessment

Living standards assessments for housing and cars are limited for 500,000 taxpayers. Favorable criteria are expanded for freelancers in settlements up to 1,500 inhabitants, to reflect local conditions. More specifically, as the prime minister mentioned in a related post on X, there will be a reduction of living standards assessments for housing and cars for 500,000 taxpayers, as well as a 50% reduction in deemed income for freelancers in settlements outside Attica up to 1,500 inhabitants and exemption from deemed income for new mothers during the year of birth and for 2 years.

Μειώνουμε τα τεκμήρια διαβίωσης για κατοικίες και αυτοκίνητα για 500.000 φορολογούμενους. Διευρύνονται τα ευνοϊκά κριτήρια για τους ελεύθερους επαγγελματίες σε οικισμούς έως και 1.500 κατοίκους. Ενώ θεσπίζουμε συντελεστή 25% για εισοδήματα ενοικίων από €12.000 έως €24.000. pic.twitter.com/wGPA190k9X

— Prime Minister GR (@PrimeministerGR) September 6, 2025

Housing through utilization of public land

Three former military camps (Moschato, Ziaka – Thessaloniki, Manousogianakis – Patras) are granted for the construction of 2,000 apartments: 25% will be allocated to Armed Forces personnel and 75% to citizens without a first residence.

Investments in defense and automotive industry

The deduction on investment expenses to be made in Greece in the defense and vehicle manufacturing sectors is doubled, up to €150 million, to attract major projects in alignment with European common security guidelines.

SMEs and financing tools

A National Extroversion Strategy is implemented and a licensing simplification bill for industry is promoted, while Special Spatial Plans for industry and tourism are completed. Actions worth €200 million for extroversion are planned, €780 million through TEPIX III for favorable loans, Agricultural Entrepreneurship Fund from 2026, €50 million for pharmaceutical innovation. From European Social Climate and Modernization Funds: €700 million for energy upgrading of SMEs, €200 million for reducing energy costs in industry and €300 million as a start for green coastal ships.

It should be noted that the specification of the measures announced by the prime minister will be made on Monday, at 11 am, by the Minister of National Economy and Finance Kyriakos Pierrakakis.

A table with the new income taxation rates released by the Ministry of Finance is attached.