When a system “hits the ceiling,” two things can happen: it can either stabilize with the right decisions or collapse under the weight of its own inability to manage success. Greek tourism finds itself at exactly this point in 2025. Travel revenue for the January-May 2025 period locked in at €4.3 million, marking a 12.7% increase compared to the same period in 2024. According to data from the Institute of the Association of Greek Tourism Enterprises (INSETE), this growth stems from both increased revenue from European Union residents (10.9%) and rising income from other countries (15.1%). Particularly noteworthy are revenues from the United Kingdom and Germany, recording increases of 13.3% and 9.9% respectively, in contrast to revenues from France and Italy, which fell by -7.8% and -4.8% respectively.

Crete celebrates while the Cyclades worry. International air arrivals leave a bittersweet taste for coming years. Specifically, from January to June 2025, 10.3 million international air arrivals were recorded, showing a 5.7% increase compared to the same period in 2024. Crete emerges as the big winner of the semester, counting the most international air arrivals with 1.9 million passengers, up 86,000/4.7% compared to the same period in 2024. In Heraklion, arrivals reached 1.4 million, up 74,000/5.7%, while Chania recorded 544,000, up 12,000/2.3%. The Dodecanese follows with 1.5 million arrivals (19,000/1.3%) and the Ionian Islands with 1.3 million passengers, showing an increase of 59,000/4.9%. Specifically, Corfu recorded 666,000 international arrivals (33,000/5.1%) and Zakynthos 343,000, up 16,000/4.9%. Kefalonia’s arrivals reached 121,000, showing an increase of 5,000/4.2%, while Aktion recorded 132,000, up 6,000/4.8%. Conversely, the Cyclades – the heavily promoted brand of Greek tourism – “bid farewell” to growth, declining in the first half of 2025 with a drop of 42,000/11.5% compared to 2024. Santorini’s example is characteristic, recording 189,000 arrivals, down 44,000/19.1% compared to last year’s corresponding period.

What’s to blame

Despite the impressive performance of the first half of 2025, the warnings are clear: Greek tourism is approaching its peak but showing signs of fatigue. Without timely intervention to address imbalances, the upward trajectory could soon turn into free fall. Tourism authorities warn: Destination capacity is being exhausted and the model’s sustainability is now questionable.

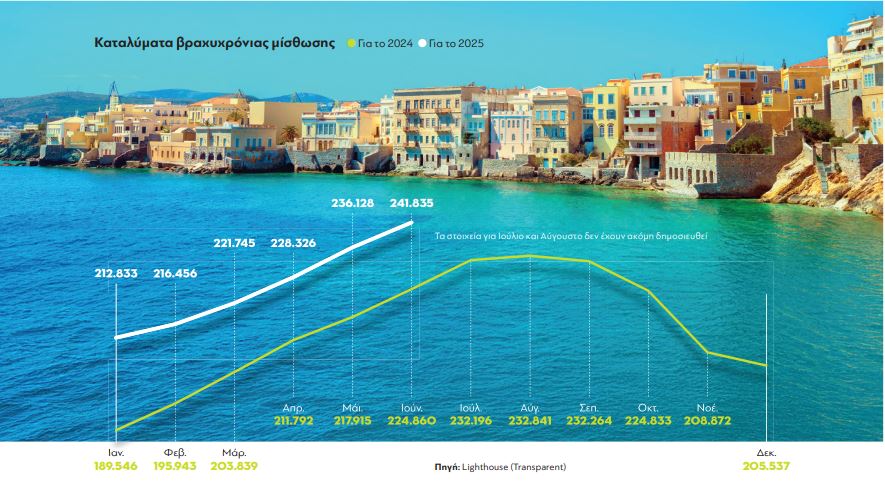

As for what’s to blame and why a blessed country like Greece cannot maintain consecutive years of growth, they identify two main causes: chronic infrastructure deficiencies and endless imbalance caused by various forms of non-traditional tourist accommodations. In other words, the signs of fatigue that make 2025 perhaps the last growth year are due to the uncontrolled spread of short-term rentals, which not only disrupts balance in many areas but leads to overtourism phenomena and displacement of local residents. Already, the development of short-term rental accommodations during the first half of 2025 shows continued growth compared to the same period in 2024, reinforcing a controversial trend that began in 2023, became more visible in 2024, and even stronger this year. In May, with 236,000 properties, a record was set in the number of available short-term rental accommodations, the highest value recorded from January 2019 to date – a record broken again in June with 242,000 properties, recording a new increase of 17,000 compared to 225,000 in June 2024.

Published in Parapolitika newspaper