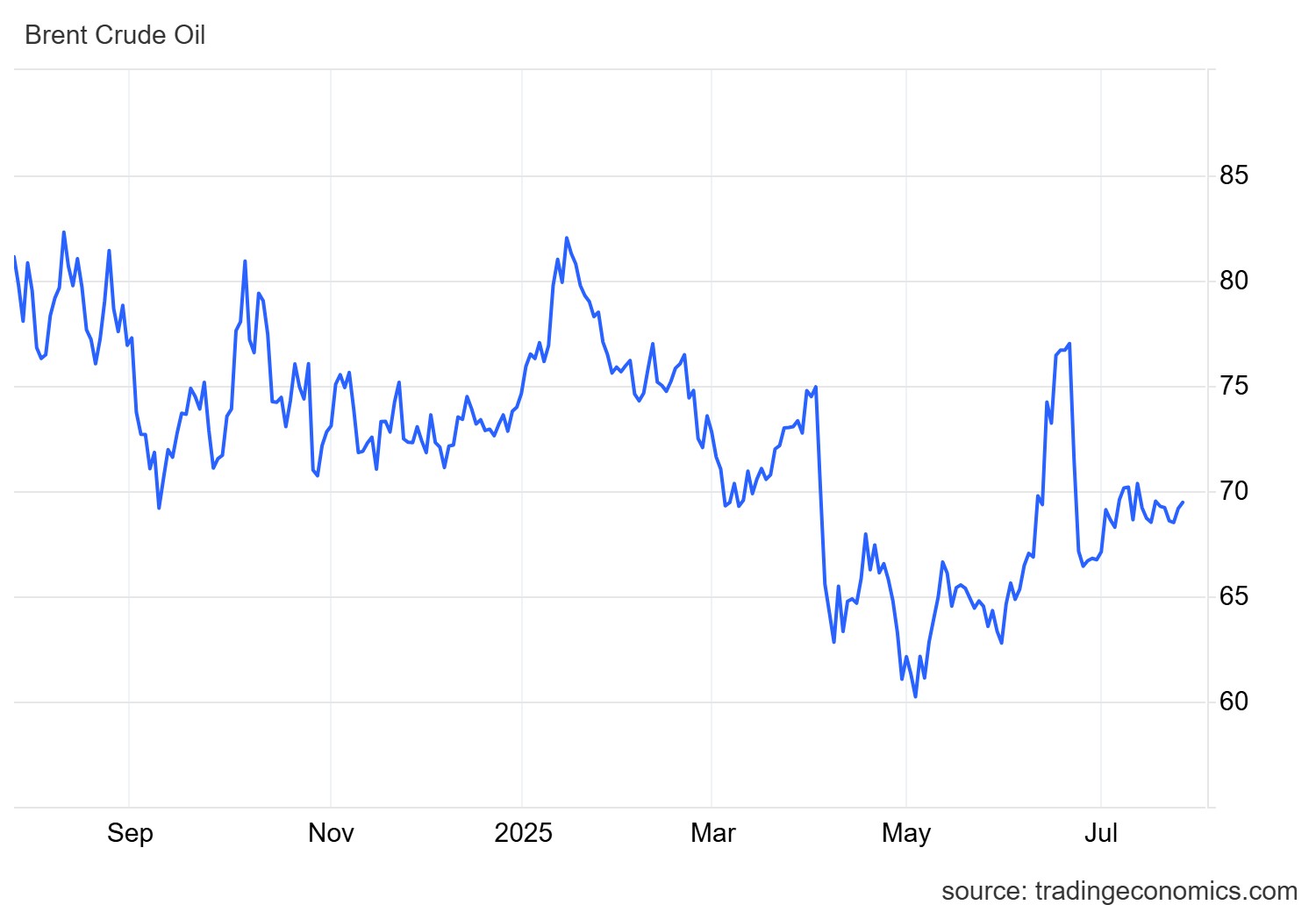

Oil prices are showing significant upward movement today, with Brent crude recording a weekly high of $69.47 per barrel. The positive atmosphere surrounding trade negotiations is boosting expectations for increased energy demand, offsetting concerns about potential supply increases from Venezuela.

Brent crude reaches weekly high with 0.42% gains

Futures contracts for Brent crude oil are moving higher by 29 cents, posting a 0.42% increase and reaching the weekly high of $69.47 per barrel. Meanwhile, U.S. West Texas Intermediate (WTI) is strengthening by 0.44%, bringing the price to $66.32 per barrel.

The upward trajectory of oil aligns with positive stock market performance, as investors believe trade agreements will boost global economic activity.

Trade agreements support energy demand

The prospect of new trade agreements between the U.S. and its trading partners ahead of August 1st is creating optimism in the markets. The United States completed an agreement with Japan, while the European Union is proceeding with negotiations for an agreement that provides for a basic 15% tariff with possible exemptions.

As ING analysts point out, optimism about trade talks appears to outweigh concerns about enhanced supply from Venezuela, keeping oil at elevated levels.

Venezuela: Potential production increase of 200,000 barrels

The U.S. is considering allowing partners of state-owned PDVSA, including Chevron, to operate on a limited basis in Venezuela. This move could increase oil exports by more than 200,000 barrels per day.

The potential supply increase would benefit American refineries by reducing tightness in the heavy crude oil market, according to analysts.

Weekly performance and supportive factors

So far this week, Brent is showing gains of 0.4%, while WTI is down 1.4%. On Thursday, both contracts posted gains of about 1% due to reports of restrictions on gasoline exports from Russia.

Additionally, U.S. oil inventory data from the Energy Information Administration (EIA) showed a decline of 3.2 million barrels last week, reaching 419 million barrels. The decline significantly exceeded analysts’ forecasts for a 1.6 million barrel decrease, further strengthening oil prices.