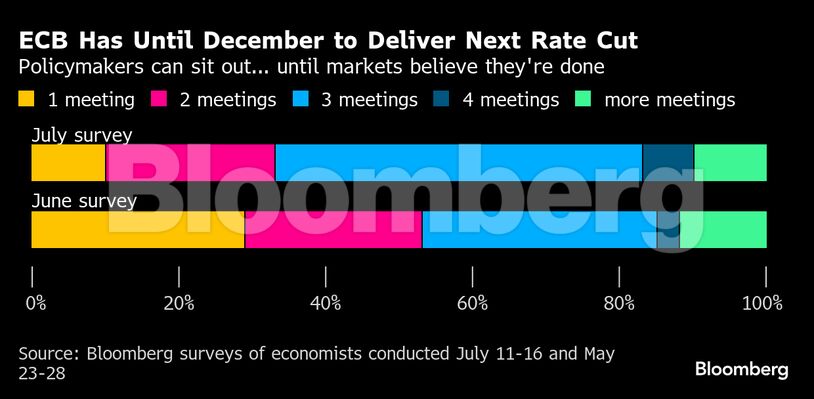

The European Central Bank (ECB), according to a new survey by Bloomberg of economists, may delay its final interest rate cut until December, without investors interpreting this as a signal that monetary easing is complete. The Bloomberg survey highlights the changing stance of analysts toward the ECB’s monetary policy.

Most economists continue to predict the last 25 basis point cut in the deposit rate to 1.75% in September, following a pause at the upcoming meeting. However, half of the Bloomberg survey participants believe the bank could remain inactive for three consecutive meetings without causing market concerns about ending the accommodative policy.

ECB in wait mode until December

This percentage has increased compared to previous surveys, due to escalating uncertainty in the international trade environment. The choice to extend the period until the next cut has already been hinted at by ECB officials, led by President Christine Lagarde. Lagarde stated that the Bank is in a “good position” to address potential challenges both in economic growth and inflation. Nevertheless, after the summer, views diverge and consensus weakens.

While Executive Board member Isabel Schnabel believes the bar for additional cuts is “extremely high,” Finland’s Olli Rehn and France’s François Villeroy de Galhau worry that price increases will fall short of 2%, especially if the euro strengthens further against the dollar.

The July decision “is expected to be relatively straightforward, with most Governing Council members likely supporting keeping rates unchanged,” said Fabio Balboni, senior eurozone economist at HSBC.

Predictions for the timeline of cuts

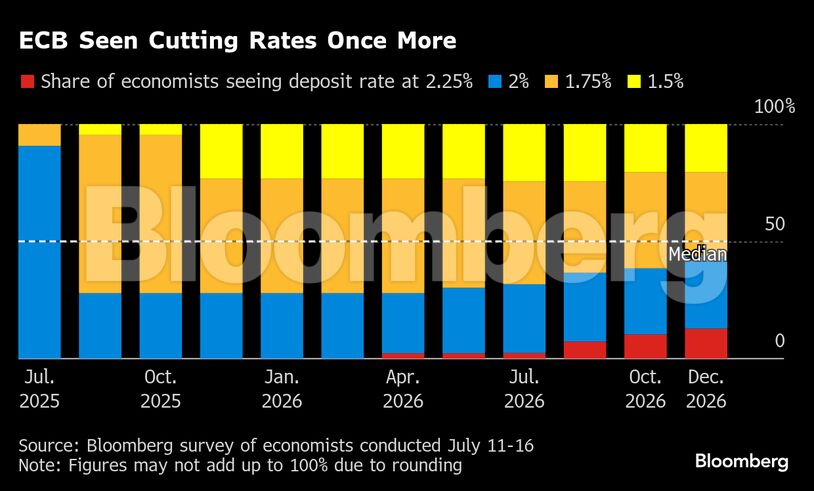

About a quarter of Bloomberg survey participants believe the ECB has already completed its interest rate cuts. Nearly half predict one final move in September, while 21% see it coming in December.

For December, Mariano Valderama, chief economist at Intermoney, predicts the first increase. While his forecast for rate hikes is the earliest, about one in five respondents expects an increase before the end of 2026.

Strategy of waiting and monitoring

The ECB is adopting a wait-and-see stance ahead of the July meeting, but Bloomberg Economics analysts estimate it will proceed with new rate cuts in September and possibly December. “The ECB is monitoring and waiting,” commented David Powell, senior eurozone economist. He predicts that the upcoming July 24 meeting will have similar language to that of June, without commitments, but keeping the door open for further easing.

The future of monetary policy will not depend exclusively on domestic economic conditions. As analysts point out, the main uncertainty factor remains external policy and geopolitical situation, mainly the course of trade negotiations between the EU and US. Although the European Union showed it was approaching an agreement, US President Donald Trump threatened 30% tariffs, raising the geopolitical temperature.

Balance between guidance and strategic ambiguity

Julie Joffe, strategic analyst at TD Securities, notes that the course of negotiations is “the most critical element,” as it could upset the delicate balance between domestic demand stability and pressure from the external environment.

“The main challenge,” emphasizes SEB’s Jesse Hilhälä, “is to avoid the possibility of markets moving either toward expecting a new cut or toward the impression that the cycle has closed.”

Market expectations and future forecasts

Markets appear cautious: the probability of rate cuts in September is priced below 50%, while a cut by year-end is considered almost certain. In September and December, ECB policymakers will have updated economic forecasts for the 20-country eurozone at their disposal, which will determine the next step in monetary strategy.

Inflationary challenges and the strong euro

In its most recent June forecast, the ECB estimated that inflation will stabilize at the 2% target in 2027, with 2026 preceding at an average rate of just 1.6%. The risks to the June forecasts currently appear balanced.

Despite recent losses, the euro has strengthened by nearly 12% against the dollar in 2025, with the exchange rate moving close to 1.16. ECB Vice President Luis de Guindos warned that the $1.20 threshold could pose a pressure point for the European economy. However, the market shows greater tolerance for euro appreciation. According to polls, only 25% of analysts agree with de Guindos, while most consider exchange rates up to $1.35 acceptable.