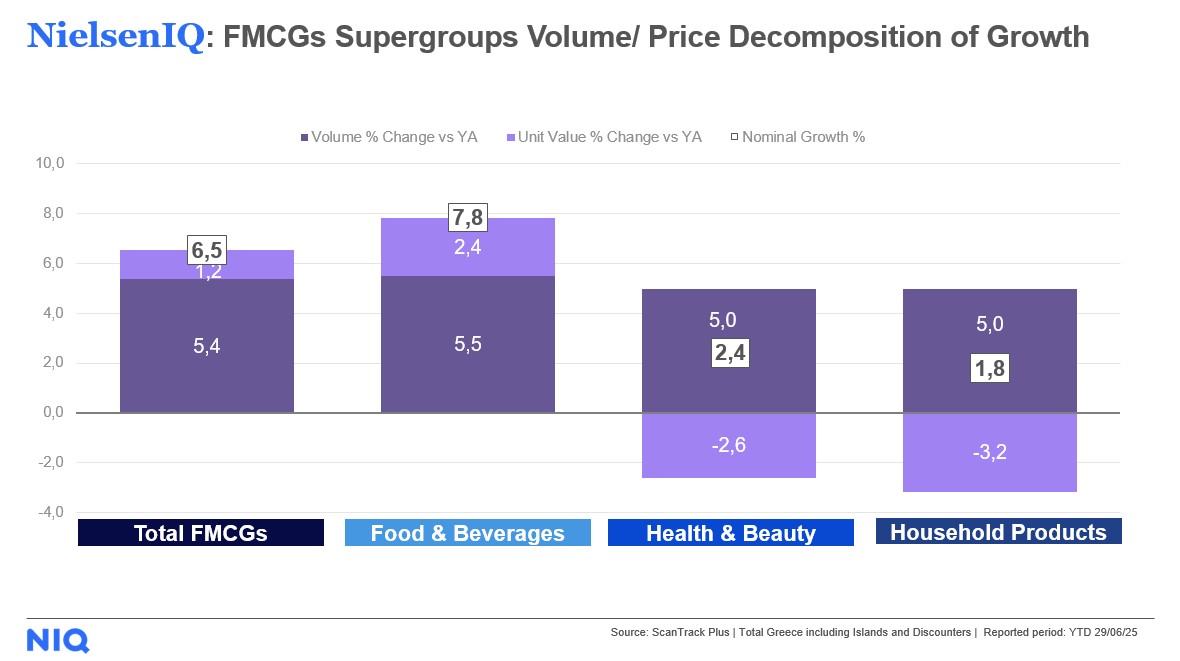

Growth of 7.9% was recorded in the total turnover of organized food retail during the first half of 2025, compared to the corresponding period last year, according to NielsenIQ data (YTD data up to June 29, 2025), the most recent available in the market. Significantly, fast-moving consumer goods are driving this growth, accounting for 70% of organized retail sales and developing by 6.5%. Breaking down this positive trend in sales volume evolution and average price, it’s evident that demand is driving FMCG growth (5.4%), as the average basket price increased more moderately during the first half of the year, by 1.1%.

Read: IELKA: Staff recruitment and climate change at the center of retail executives’ concerns

NielsenIQ: Deflationary trends in non-food super-categories

Analyzing market data further, particularly interesting is the fact that only in the super-categories of standardized food & beverages is there average price growth (+2.4%), while in non-food super-categories we now have deflationary trends compared to a year ago, with Home Care Products reducing their average price by -3.2%, as well as Personal Care and Beauty Products by -2.6%.

Regarding promotional activities and having now completed the first half of the year, it’s evident that government regulations through the code of conduct have significant impact on suppliers’ promotional strategy, with promotional intensity for all branded products decreasing further, from 68.6% in the corresponding period of 2024 to 51.3%. Indeed, this reduction is observed proportionally across all promotional types as defined by NielsenIQ, namely TPR (Temporary Price Decrease), Bonus Pack & Gift on Pack.

Branded products struggle to remain competitive against PLs

However, the reduction in promotions for branded products has not boosted the share of private label products, as one would expect, as this remains stable at 24.5%. Based on results from a recent top-line analysis conducted by Dimitris Velissaridis, Senior Customer Success Consultant at NielsenIQ, it appears that branded products are trying to remain competitive against PLs regarding price factors, significantly following EDLP (Every day low price) strategies and attempting to maintain specific price gaps. Specifically, in categories that generate 50% of FMCG turnover, while a decrease in promotional intensity of branded products is recorded, simultaneously a reduction in the distance between average prices of PLs & branded products is observed. This category group includes Greek coffee, packaged cheeses, beers, fabric softeners, baby diapers, etc.