The mission of the Independent Authority for Public Revenue, as explicitly stated in its establishment, is the determination, verification and collection of tax, customs and other public revenues that fall within its field of competence. The control of the prerequisites and criteria for receiving OPEKEPE subsidies, as well as the control of compliance with the terms of receiving them, were never within the field of competence of the Independent Authority for Public Revenue.

According to its defined framework of competences, the Independent Authority for Public Revenue receives annually a file with all the subsidies granted by OPEKEPE, in order to pre-fill the corresponding codes of income tax returns. Consequently, it obliges the beneficiaries of subsidies to include the provided funds in the amounts that determine taxable income. In any case, the cross-checks carried out by the Independent Authority for Public Revenue have exclusively tax-related purposes and are based on data received from other public bodies – in this specific case, OPEKEPE – which are considered reliable until the Independent Authority for Public Revenue is informed to the contrary, according to the prescribed control procedure by the competent bodies and authorities.

At the same time, the Independent Authority for Public Revenue has developed over time those interoperability features that have been requested by OPEKEPE, so that the latter can carry out the controls and cross-checks it has in its planning. For this purpose, it also sends any tax data that is requested. Specifically, interoperability features have been developed through which the following data is provided:

- Tax Registry data for the identification of interested parties who submit Single Aid Applications.

- Income data, in cases where the level of income is a criterion for the aid.

- Data on contracts with professional agronomists, in cases where these are a prerequisite for the aid.

- Data on agricultural plots of the taxpayer (for owned agricultural plots).

- ATAK confirmation regarding agricultural plots in the taxpayer’s property status (for rented agricultural plots).

- Agricultural plot data based on ATAK and the aid recipient.

Additionally, in order to strengthen its digital arsenal in the fight against tax evasion in the agricultural products sector, it has developed digital tools to increase the effectiveness of tax controls, such as the digital dispatch note. Furthermore, the Independent Authority for Public Revenue carried out through its audit mechanism, during the tax years 2019 to 2025, actions and controls in more than 45,000 cases of agricultural businesses, with the results being as follows:

1. Tax audits on farmers 2019-2025

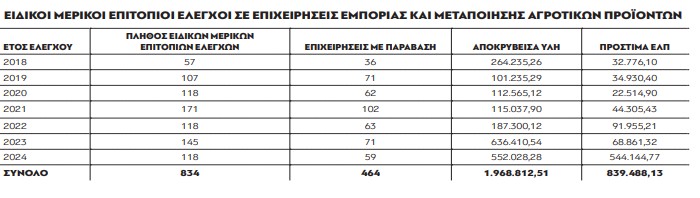

2. Partial on-site inspections

During 2024, 885 inspections were conducted on farmers (perennial and non-perennial crops, animal production) with an average violation rate of 38.35%.

3. Actions for taxpayer compliance regarding business commencement or activity changes

The subject of the above action was the identification of taxpayers who received subsidies from OPEKEPE exceeding €5,000 and had not been subject to the regular VAT regime, according to the current legislative framework.

4. Other actions – investigations

i. Detection and dismantling of an illegal agricultural products trafficking and distribution network. This involves a network of issuing and receiving fictitious tax documents for agricultural products in Thessaly, which has extensions in Fthiotida and Thessaloniki. The involved businesses resulted in the issuance of 1,192 fictitious tax documents with concealed material of approximately €7.8 million and estimated lost revenue of €3 million. The investigation of the above network continues within 2021 and from the indications so far, the amount of total fictitious transactions appears to exceed €15.5 million.

ii. In an individual agricultural products and animal feed trading business in Eastern Peloponnese, during the periods 2015-2018, it was found that 66 fictitious tax documents with a total value of €785,000 were received, as well as the non-issuance of numerous tax documents with a total value of €283,000.

iii. A farmer in Pella during the years 2016-2017 concealed income amounting to €0.3 million. The above were detected after opening and processing bank account data.

iv. Tax and customs inspectors, together with other bodies, participate each year in an operation by the Ministry of Rural Development and Food to combat the illegal import and circulation of lamb and kid meat, aimed at preventing the phenomenon of “hellenization” of imported lamb and kid meat.

v. Within the framework of operation “Siege”, at 53 points in the Prefectures of Imathia and Pella, the following were found: a business found not to have ownership titles for the possession of 16 loads of peaches, with a total weight of 525 tons, 20 producers circulating peaches without invoices, with a total weight of 110 tons, a business found to have issued 5 invoices inaccurately, concealing taxable material worth €1,400 (48-hour closure), a business found to have a series of violations of non-submission or inaccurate submission of returns, summary tables and change declarations.

Published in Parapolitika