When institutional and private investors start to “see something” in an artist’s works, this rarely remains at the level of intuition. Usually, the works are then incorporated into some corporate collection or personal portfolio. Other strategic placements follow, buying and selling, and gradually the artist’s position in the global art market ranking is re-evaluated. In short, upward potential is anticipated. This exact dynamic confirms the trajectory of Ed Ruscha, a name that records impressive sales growth in the contemporary art market, in which powerful art dealers have invested, as well as private entrepreneurs, such as Jeff Bezos, or major financial institutions, such as UBS.

The hot trajectory of Ed Ruscha’s artwork prices

In spring 2025, Ruscha’s painting titled “Diminishing Leak” changed hands through Sotheby’s for $317,500 (within initial estimates).

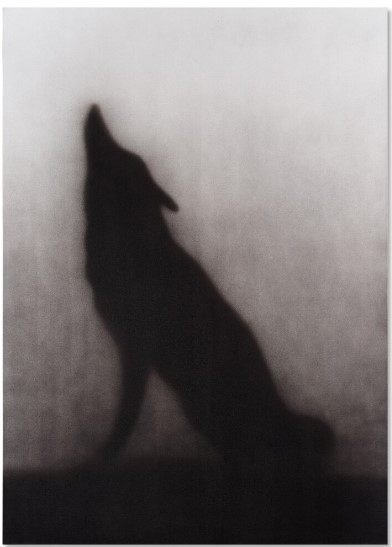

During the same period, another work titled “Yip Yip” (acrylic on canvas, 213.4×152.4cm) from 1994 achieved the staggering price of $2.24 million, leaving far behind the initial estimate of $600,000. The work had been purchased in 2008 for $1,070,500 and within 17 years managed to record an absolute return of 110% with an annual return of 6.46% (without compounding).

A particular role in promoting Ed Ruscha’s works is played by the fact that UBS holds over fifty Ed Ruscha works, which are moreover characteristic of his artistic style. One of the most emblematic works in UBS’s collection is “Spam Study” from 1961-62, which, as experts say, is quite possibly the smallest painting he ever created. Moreover, it is a study for a larger work that belongs to the permanent collection of the Los Angeles County Museum of Art.

A pivotal moment in Ruscha’s trajectory was the investment made in his work by American tycoon Jeff Bezos, with capital of $53 million. This was for the work titled “Hurting the Word Radio #2,” which he had pursued at a Christie’s auction in 2019, setting a record in Ruscha’s price trajectory. After this move, prices for Ruscha’s works -which were already trending in the international contemporary art market- doubled. Many of his works that changed hands on the art exchange achieved high prices, often exceeding estimates.

The same year, Ruscha’s work titled “I tried to forget to remember” (acrylic on canvas, 182.9×243.8cm) from 1986 was expected to reach £5 million, but its final price closed at £8,237,000. In one of the most recent transactions, the painting titled “You Cannot Be Serious” (61×70.8 cm) from 2008 had been estimated at $450,000, however its final value climbed to $800,000 (Sotheby’s, 2024).

Finally, the significant provenance of works from powerful art market players such as Gagosian, Leo Castelli, Robert Littman, James Corcoran, Manny Silverman and Koppel galleries has played a catalytic role in shaping Ed Ruscha’s prices. Characteristic is the example of the work “Smash” with provenance from Leo Castelli Gallery in New York. In 2014, it had been estimated around $15 million and ultimately its value exceeded $30 million.