The stake of UniCredit rose to 9.768% following the absorption of Alpha Holdings, as announced by Alpha Bank on the stock exchange. It is noted that the Italian bank has the potential to acquire an additional 247,918,401 shares, representing 10.709% of Alpha Bank, bringing its total potential stake to 20.477%.

Read: What the Alpha Bank – UniCredit deal means for Greek banks

Alpha Bank’s official announcement:

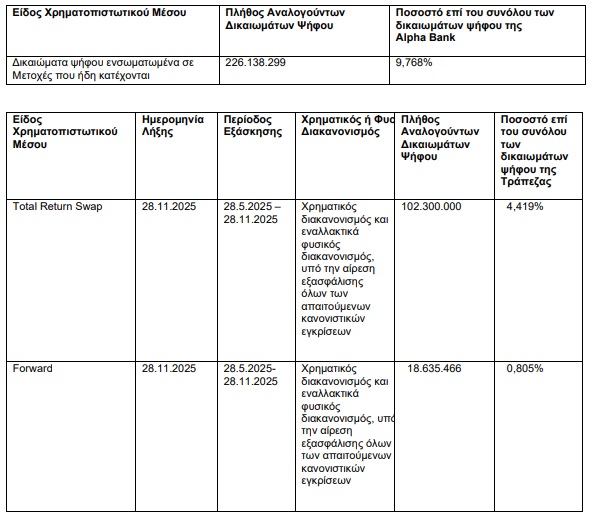

“Alpha Bank (the “Bank”) announces, in accordance with Law 3556/2007, that UniCredit S.p.A, following its relevant notification dated June 30, 2025, after the completion of the merger of Alpha Services and Holdings S.A. with the Bank on June 27, 2025, holds voting rights corresponding to 9.768% of the total voting rights of the latter.

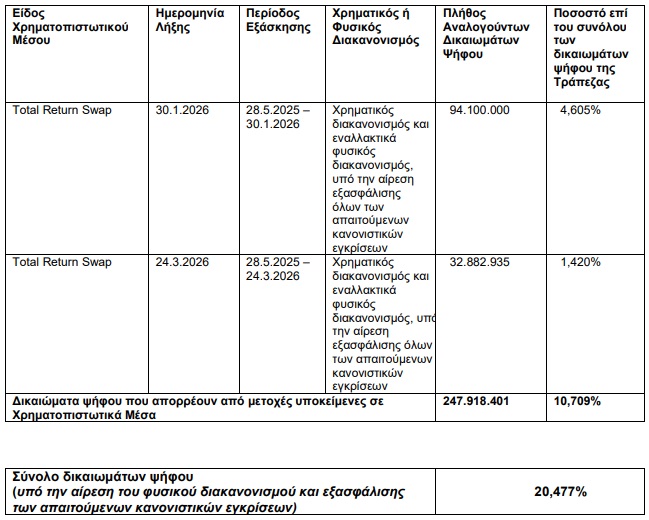

Furthermore, UniCredit S.p.A notifies that the financial derivatives it has entered into with cash settlement as the default method and alternatively physical settlement, subject to obtaining all supervisory approvals, may lead to the acquisition of 247,918,401 ordinary voting shares corresponding to 10.709% of the Bank’s total voting rights, bringing the total voting rights to 20.477%”.

The Bank’s voting rights are analyzed as follows:

“It is clarified that until and subject to physical settlement, Unicredit S.p.A. will not have any influence on the exercise of voting rights arising from the shares underlying these financial derivatives,” the Alpha Bank announcement further states.