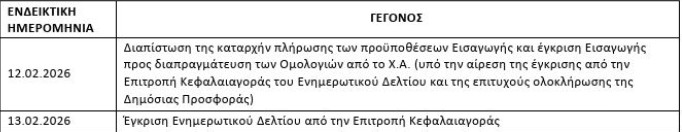

CAPITAL CLEAN ENERGY CARRIERS CORP. announces that starting February 13, 2026, it is making available to the investment community the approved Prospectus for the issuance of a common bond loan, totaling up to €250 million, with a minimum issuance amount of €200 million and a seven-year duration. The loan will be divided into up to 250,000 dematerialized, common, registered bonds with a nominal value of €1,000 each. The issuance was decided by the Company’s Board of Directors on February 10, 2026, and the relevant Prospectus was approved by the Capital Market Commission on February 13, 2026, in accordance with the applicable European and Greek regulatory framework.

The bonds will be offered to the investment community through a public offering in Greece, using the Electronic Book Building service of the Athens Stock Exchange. After completion of the public offering, the bonds will be registered in the Dematerialized Securities System and will be admitted for trading in the Fixed Income Securities Category of the Regulated Market of the Athens Stock Exchange. The Athens Stock Exchange has already approved in principle the admission, subject to approval of the Prospectus and successful completion of the public offering.

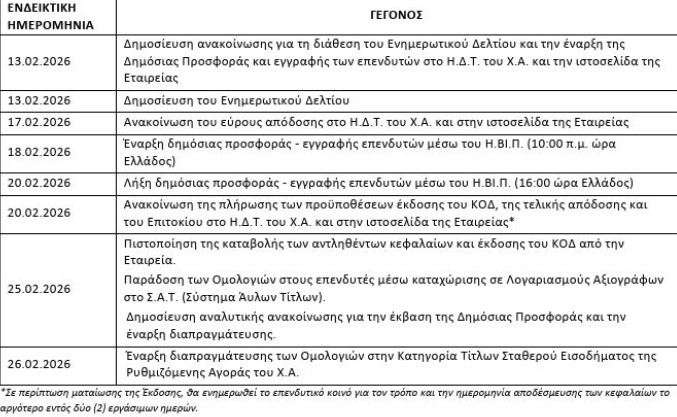

The public offering will begin on February 18, 2026 (10:00 a.m.) and will be completed on February 20, 2026 (4:00 p.m.). The final yield and interest rate will be announced the same day. On February 25, 2026, certification of capital payment, bond issuance, and delivery of bonds to investors is scheduled, while trading on the Athens Stock Exchange is expected to begin on February 26, 2026. The Prospectus is available electronically through the websites of the Company, the Athens Stock Exchange, the Lead Underwriters, and the Capital Market Commission, as well as in print form upon request.

The Lead Underwriters are Piraeus Bank, Alpha Bank, Optima Bank, and EUROXX.