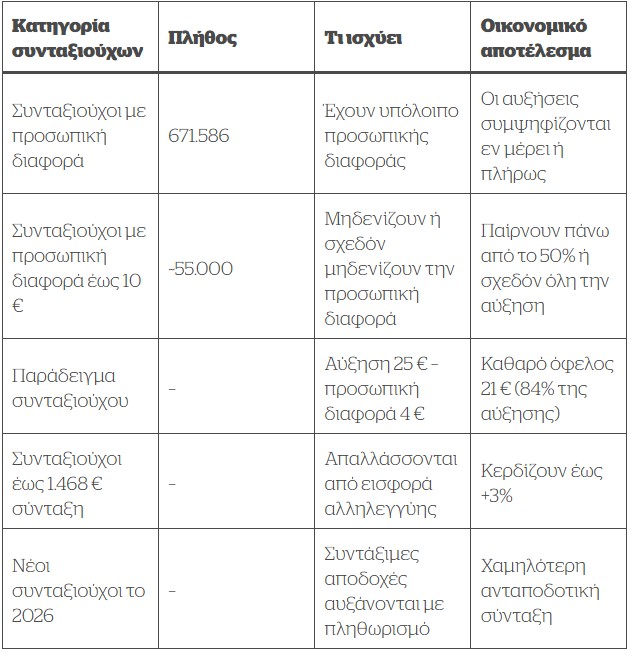

Significant developments are expected in 2026 for thousands of retirees who maintain a personal difference in their pensions. Of the total 671,586 beneficiaries who continue to have this financial burden, approximately 55,000 individuals will manage to eliminate almost completely or entirely the amount of the personal difference that is deducted from them monthly.

Which retirees will see the biggest increase

The retirees who will benefit most are those with remaining personal difference below 10 euros. This category of beneficiaries will be able to absorb more than 50% of the scheduled increase, while in many cases complete elimination of the personal difference will be achieved. A characteristic example is a retiree who is entitled to a monthly increase of 25 euros and maintains a personal difference of only 4 euros. In practice, this individual will receive a net increase of 21 euros, corresponding to 84% of the total adjustment, essentially seeing the personal difference disappear from their pension.

Who are the big winners

Significant advantage is gained by retirees with monthly pensions up to 1,468 euros. This category is now exempt from the solidarity contribution thanks to the indexation of tax brackets being implemented.

This exemption means that beneficiaries avoid a deduction that could reach up to 3% of their total pension. Practically, this represents a double benefit: on one hand they receive the scheduled increase and on the other hand they are not burdened with the solidarity contribution that previously reduced the final amount they received.

Who are considered the losers of the changes

In contrast to existing retirees, insured individuals who will retire during 2026 are in a more disadvantageous position. This group will not have the ability to claim higher contributory pension, as their pensionable earnings will continue to be calculated based on the inflation index. The absence of adjustment based on the wage index means that new retirees will receive lower benefits compared to what they could secure if a different calculation method were applied. This fact makes them the category that is negatively affected by the current regulations of the insurance system.