The tax landscape for real estate is changing with the government’s package of measures taking effect from January 1, 2026, reducing tax burdens for more than 1.5 million property owners, landlords, buyers, and those renovating homes. At the core of these interventions are reduced tax rates on rental income, cuts to the ENFIA (Unified Property Ownership Tax) for specific categories of owners, as well as the “freezing” of both VAT on transfers of newly built properties and capital gains tax on sales.

At the same time, property owners who make closed homes available to the market or proceed with renovation and energy upgrade works will be able to benefit from tax exemptions and tax deductions, significantly reducing their final “bill”.

Real estate: Tax exemptions and tax deductions

Meanwhile, living standard presumptions for residences are being cut by 35%. Specifically, with the new tax regime, the burden from the new year will be lower or even zero for the following categories of taxpayers:

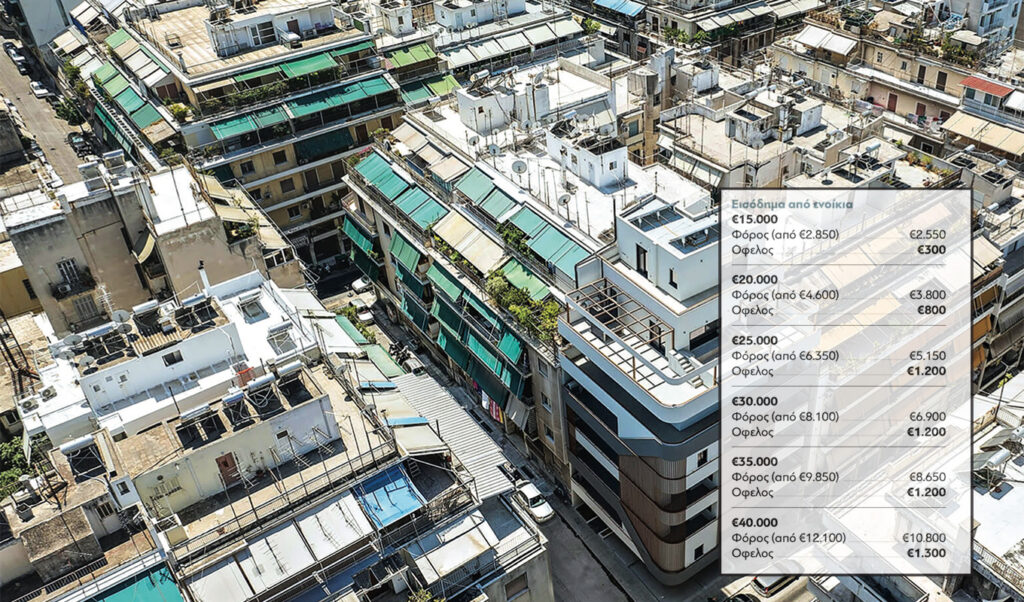

- Landlords A. For 161,587 property owners who collect rent above 12,000 euros, tax is reduced by up to more than 1,300 euros annually, depending on rental amount, due to the new intermediate rate of 25%, instead of the current 35%, for income from 12,000 to 24,000 euros.

According to the new scale, which will apply from 2026, for income up to 12,000 euros the rate remains at 15%, from 12,001 euros to 24,000 euros it is set at 25%, for amounts from 24,001 euros to 35,000 euros it rises to 35% and for above 35,001 euros to 45%. With these changes, the benefits for property landlords are as follows:

It is noted that the latest data from processing tax returns show that approximately 1.8 million taxpayers report rental income exceeding 8.5 billion euros annually.

Vacant properties and short-term rentals

B. Property owners who rent out vacant homes or convert short-term to long-term rentals by December 31, 2026 will have complete tax exemption on income they earn for three years. The measure aims to strengthen the availability of inactive homes in the rental market, increasing the supply of available apartments and contributing to stabilizing rental prices that are in constant rally. The tax exemption applies to rentals of homes that were vacant for at least three years, as well as homes that were exploited in short-term rental, up to 120 square meters.

If the tenant has more than two children, for each additional child the limit increases by 20 square meters. The rental duration must be three years. If the tenant leaves the residence, the exemption will continue until completion of three years if within three months the owner enters into one and only new three-year primary residence contract.

For rentals to public employees, unlimited rentals of at least six months duration are permitted and the deadline for re-renting in order not to lose the exemption is six months, with the lapse of which the exemption is lost for the remaining period. If the residence is made available for short-term rental within three years, the exemption ceases to apply retroactively from the first year of rental, so there will also be an issue of retroactive payment of income tax for all collected rents that had been exempted from income tax.

- Property owners: More than 1 million taxpayers with primary residence in small villages will have an automatic 50% discount on ENFIA for 2026 and complete exemption from 2027. The measure applies to rights in real estate concerning primary residence belonging to natural persons, Greek tax residents, whose primary residence, as shown in the income tax declaration, is located in settlements with population less than 1,500 inhabitants, excluding settlements located in the Attica Region (except the Regional Unit of Islands).

The 50% reduction in ENFIA is granted exclusively for rights (full ownership, bare ownership, usufruct) on the primary residence and provided the total value of 100% full ownership does not exceed 400,000 euros.

Attention: The discount applies only to the primary residence and does not apply to other properties of the taxpayer, such as secondary or vacation homes, plots or agricultural land, as well as for primary residence whose objective value exceeds the limit of 400,000 euros. The regulation covers 12,720 settlements with a total population of 2.15 million inhabitants, out of 13,586 settlements nationwide.

Also, reductions of up to 35% in living standard presumptions for residences take effect from this year, exempting hundreds of thousands of taxpayers from additional taxes on presumptive income. The living standard presumption for primary residence is calculated progressively based on its surface area as follows:

Living standard presumptions burden taxpayers whether they are property owners themselves or rent them or have been granted them free of charge. In case the taxpayer declares “hosted” they are exempted from the living standard presumption for the residence, as this burdens the “host”.

- Buyers VAT on transfers of newly built properties is “frozen” for 2026, where only the 3% transfer tax will be imposed. The VAT suspension will apply to all unsold properties of the developer, while the measure significantly compresses the cost of acquiring housing due to lower burden for the buyer.

Beyond VAT, the 15% capital gains tax has also been suspended until the end of 2026, which is imposed on the difference between acquisition price and sale price of the property, based on depreciation coefficients depending on the years of holding the property by the taxpayer. The tax burdens sellers, who in turn pass it on to buyers, raising the final price of the property.

- Renovation expenses Those who carry out expenses for energy, functional or aesthetic upgrading of residences or commercial properties during 2026 will be entitled to income tax cuts totaling up to 16,000 euros, distributed over five years, from 2027 to 2031. The maximum limit of expenses amounts to 16,000 euros, while the annual tax deduction reaches up to 3,200 euros, provided that expenses have been paid by electronic means and related documents have been transmitted to AADE.

It is noted that for tax reduction, material purchase expenses taken into account must not exceed 1/3 of work execution expenses. In case the reduction amount the taxpayer is entitled to for the relevant tax year is greater than the corresponding tax, the surplus amount is not refunded, not offset against other tax obligations, not transferred and not deducted in subsequent tax years, nor transferred for deduction to the other spouse or other party of the cohabitation agreement.

*Published in “Parapolitika”